Private Foundation Services

Southwest Florida Community Foundation is a great resource for your private foundation. We share many things in common and will both benefit by having a close relationship. We specialize in working with individuals and families to achieve their philanthropic goals.

A private foundation can be a great vehicle for charitable giving. A close relationship will help increase the joy and impact of giving.

We can be a valuable resource in these areas:

- To re-focus the philanthropic mission statement to meet changing community needs.

- Support operational and investment management issues.

- Keeping up with new and changing government regulations, such as the 2006 Pension Protection Act or the 2001 Patriot Act, and the annual 5% payout requirement.

- Allow the founder and family to focus on more philanthropy, and less on investments and administration.

In any of these scenarios, the Southwest Florida Community Foundation will be a great ally.

We offer several options:

- Option 1: Take advantage of our new Customized Philanthropy Services program where you join us in the granting process.

- Option 2: Donate the foundation’s annual 5% required payout to a Donor Advised Fund at Southwest Florida Community Foundation (to be distributed within 12 months) OR to our Foundation Initiatives to be distributed through our grantmaking strategies.

- Option 3: Convert the foundation into a named Donor Advised Fund; we will take care of the management and investments, you can focus on granting.

We like to invite in other funders and donors into our grants process so that they can meet with nonprofit leaders, review their big ideas together and discuss needs and trends in our community. It’s what we do! And, we work with the grantees all year in helping guide them and provide program metrics to help establish measurable outcomes.

- Whether you give through the Community Foundation or through your own foundation, we believe that we all need to come together to make granting more impactful.

Click here to contact us, let’s talk about what we can do to help you with your philanthropy. Or call 239-274-5900 to speak to Carolyn Rogers.

Considering Starting a Family Foundation?

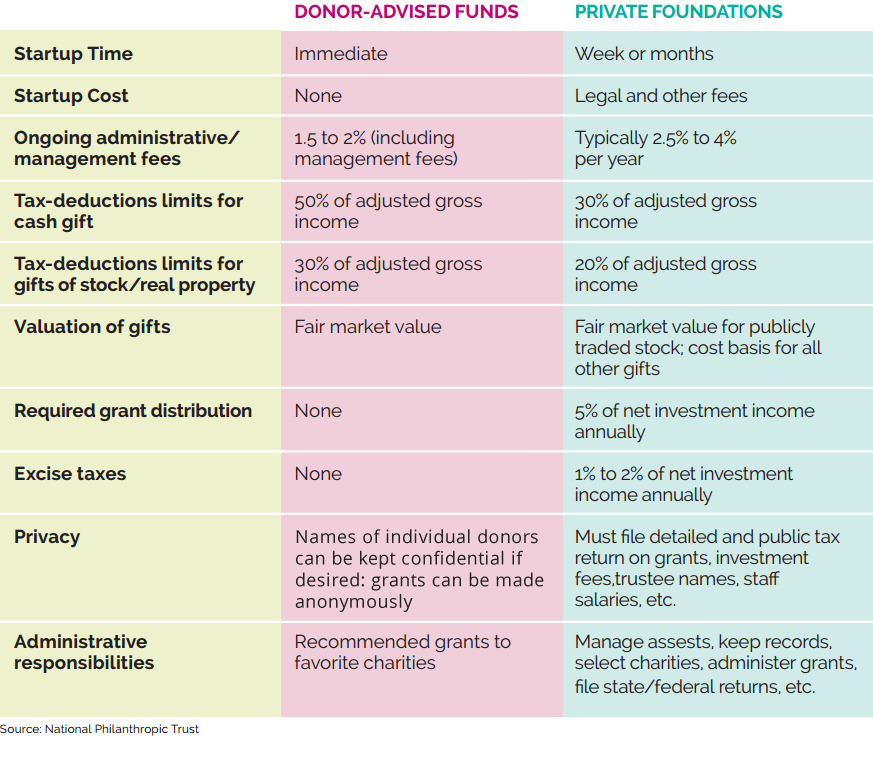

For those considering a family foundation, a fund at the Community Foundation can be a great alternative. Donor advised funds through a community foundation are ideal for pass-through grant funding with many advantages over family foundations, especially the smaller ones (under $3 million).

Legal, tax and regulatory requirements associated with private foundations are burdensome. They cost money to establish and operate, include obligations to state and federal governments and require tax-exempt status and complicated tax returns.

Below are the top 10 reasons philanthropists opt for a donor advised fund through a community foundation, according to the National Philanthropic Trust.

How They Stack Up

The costs, rules and perks of foundations and donor-advisor funds.